Tripcatcher Integration With Xero

There are 2 types of Tripcatcher account that integrate directly with Xero; the Tripcatcher Individual account and the Tripcatcher Partner account.

Tripcatcher Individual

Tripcatcher Individual is for you, the freelancer, the director, or the contractor. Tripcatcher has easy-to-use features that help you capture your business mileage.

Tripcatcher Partner

This is the multi user version. If you’re a small business, accountant or bookkeeper, Tripcatcher Partner is perfect for you. The Partner dashboard really helps you manage your clients or employees mileage expenses.

If you want to find out more we have a great case study with Lisa at Max Accountants where she talks about the benefits of using Tripcatcher with Xero for their clients.

Claim All Your Mileage Expenses

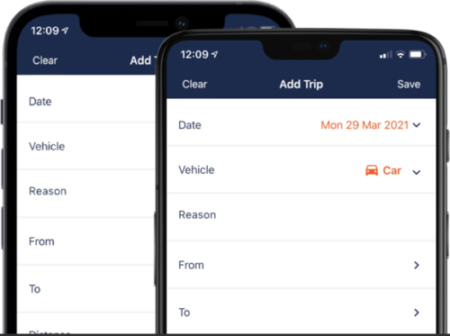

You can complete your mileage expenses anywhere using Tripcatcher on the phone or web app.

It’s very easy to use with lots of time-saving features which include:

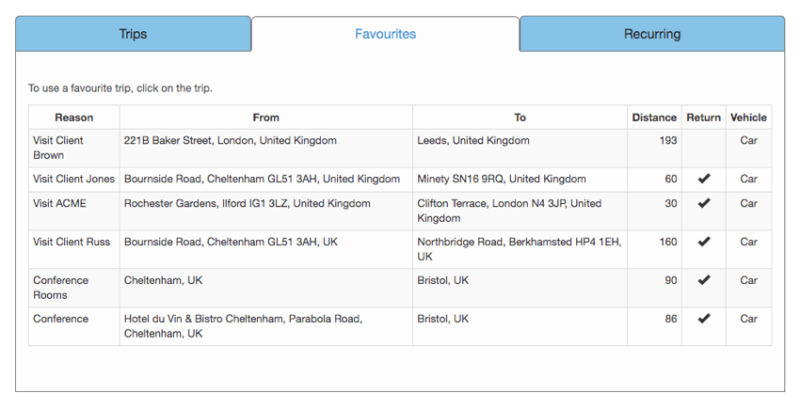

- Save business journeys as favourites which can be easily selected next time you do the same journey

- Calculates the amount of VAT your business can claim on the fuel portion of the mileage expense

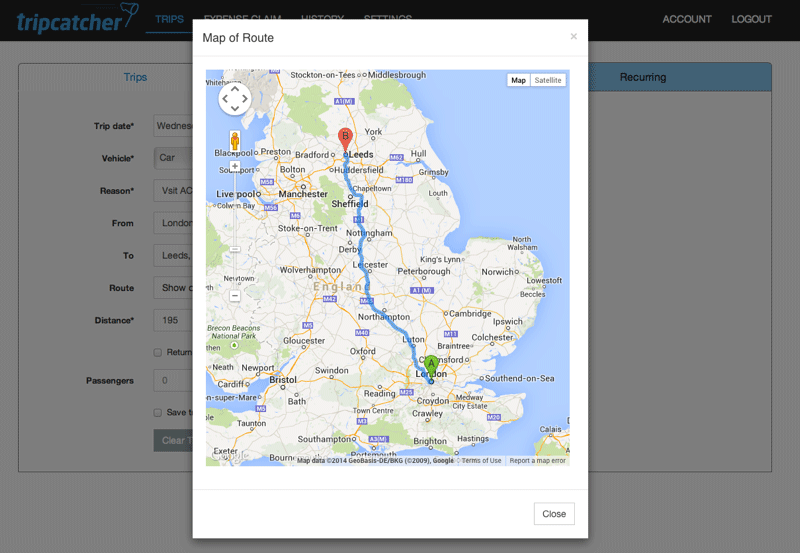

- Google Maps for calculating the distance travelled

Claiming The Right Mileage

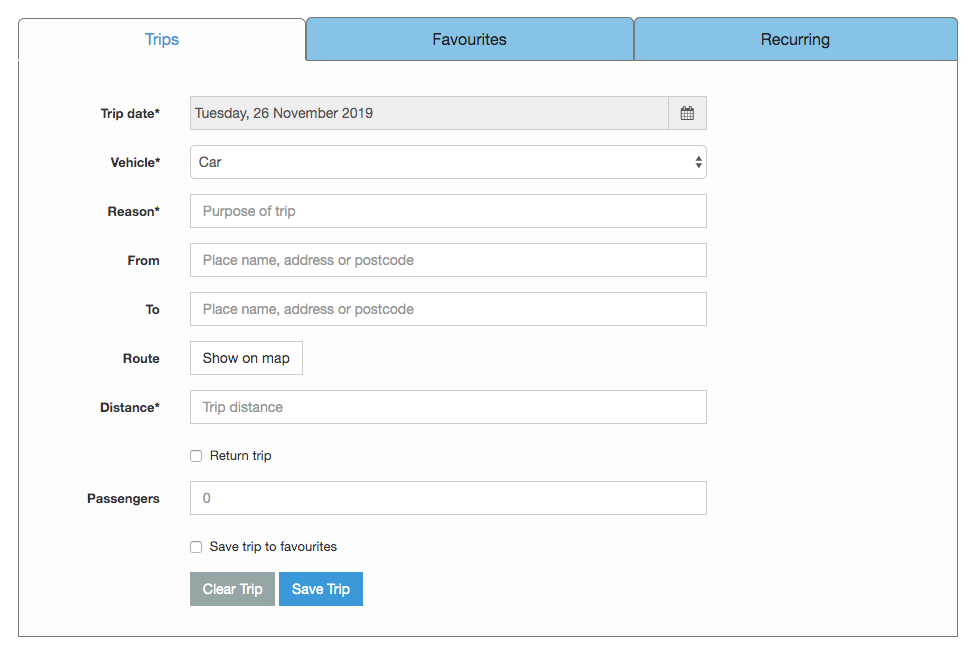

If you don’t know the exact distance you travelled on your business journey, Tripcatcher will help you out.

You can enter post codes, street names, or towns, and Tripcatcher will calculate the distance between the two locations. Tripcatcher uses Google Maps to verify the start and end locations and then to calculate the distance.

This ensures you claim the right mileage and provide the full details required by HMRC.

Save Time With Favourites

When claiming for a new business trip, simply tick the box and save it as a favourite. The next time you make the same trip, just select from the favourites table and the trip details will be automatically filled for you. This is a great time saver, 2 clicks and your business journey is saved.

This is extremely useful if using the Tripcatcher phone app. Less data entry, less time, less errors and less hassle.

Smooth Integration With Xero

You can easily publish your mileage expenses in real time to Xero. Tripcatcher integrates with the Xero Purchases (Bills) and to Classic Expenses.

Firstly, connect your Tripcatcher account to Xero; this is really simple and only done once. Once connected, your business mileage can be published as often as you want from the Tripcatcher Expense Claim page.

For the multi user Tripcatcher account extra functionality has been added that enables the Admin users to connect their Tripcatcher users to Xero.

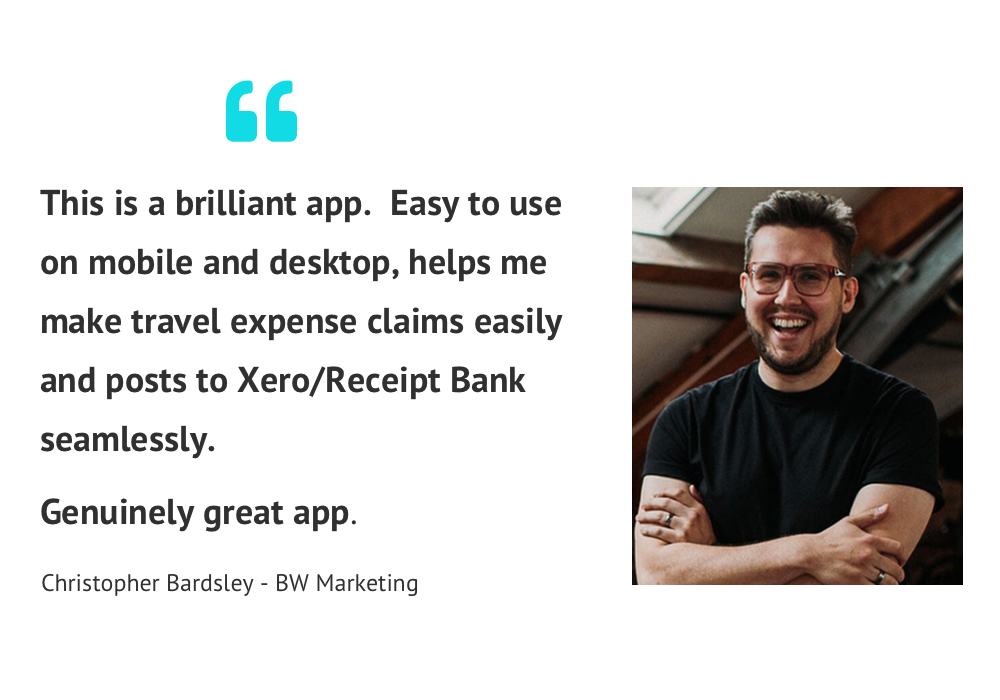

I have been using Tripcatcher for just over a year and as a small business find it a perfect tool for tracking mileage and keeping everything in one place. The integration with Xero has been faultless. Reasonably priced and does everything I need it to.

Jonathan Aspinall – Aspinall Property Management Consultancy

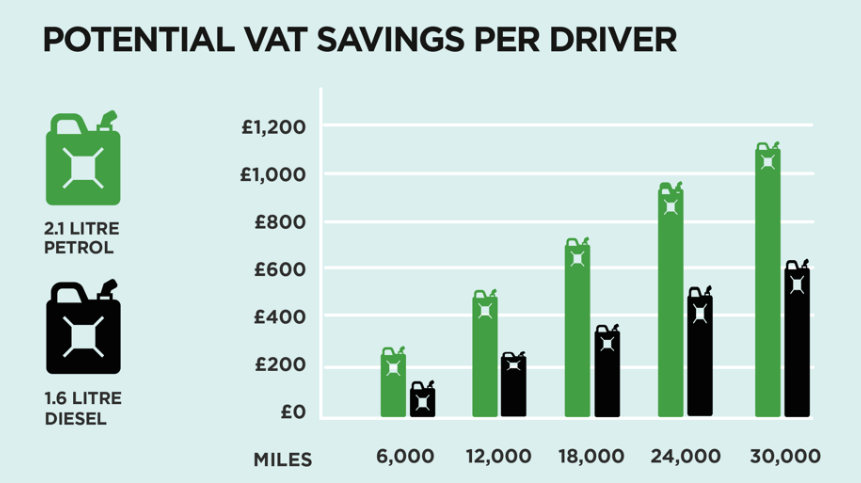

Reduce Your VAT Bill

You VAT bill is reduced by claiming back the VAT on the fuel element of your mileage claim. This VAT can be claimed for car/van business mileage.

Tripcatcher automatically selects the correct VAT rate depending on your car/van engine type. If you have opted to claim back VAT, the expense claim including the VAT element is submitted to Xero and the VAT is automatically deducted from your next VAT bill.

You can save £100s by claiming the VAT on your mileage expenses. Examples of VAT saving are shown opposite (as at 1st March 2025) .

See our blog VAT on mileage expenses – how to claim.

Save Your Business Mileage on The Go

The Tripcatcher phone app runs on both iOS and Android phones. The app is simple to use and lets you complete your mileage expenses whilst on the move. There are lots of time saving features such as Favourites, GPS Tracking and Google Maps for calculating the distance travelled.

The app also allows your Home and Office addresses to be saved and these can be easily selected on the Add Trip page, saving typing time. To find out more see the full list of phone app features.

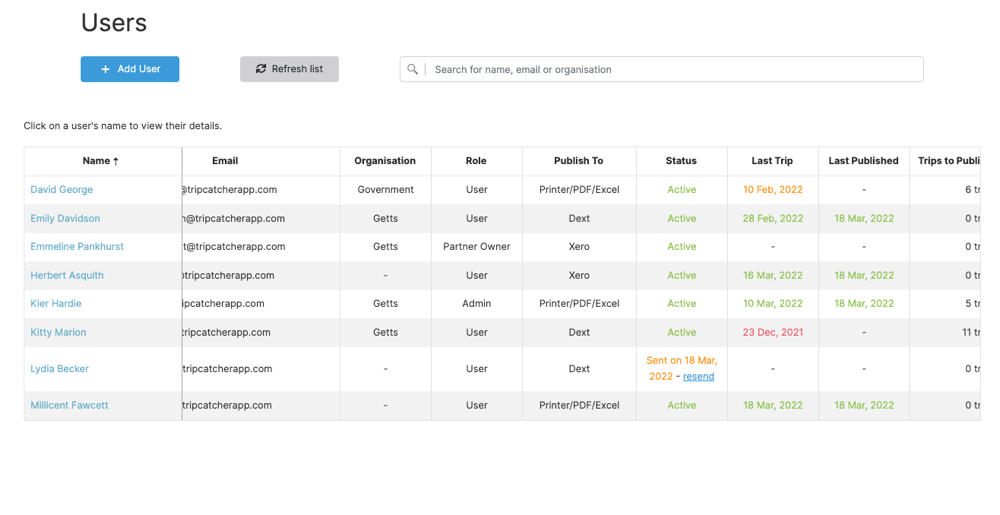

The Users Dashboard

The Users dashboard, on the multi user account, makes inviting clients/employees so easy.

Once invited, you can see if your users are up to date with their mileage expenses enabling you to be proactive in managing their accounts.

From the dashboard you can also invite administrators to help manage your clients/employees mileage expenses.

We love the Admin portal which allows us to see exactly where clients are and resolve problems much more quickly.

Brilliant little bit of software that makes mileage simple again.

Jon North, Butt Miller Chartered Accountants

A little bit about Xero

Xero is an easy to use online accounting software, designed specifically for small businesses

It’s all online, so you can work when and where you want to. Just login with your PC, Mac or mobile. Your bank statements are automatically imported and categorised, letting you see your cashflow in real-time.

Invite your team and work together on financials. You can collaborate over your up-to-date numbers. Xero has all you need to run your business – including invoicing, paying bills sales tax returns, reporting and much more.